Amazon’s internal discussions reportedly centered on adding a line item to product pages that would break out the approximate tariff fees levied on imported goods. For example, a pair of headphones manufactured overseas and sold for $50 could show an additional “Tariff: $12.25” charge. The intent, according to unnamed sources within Amazon, was to empower customers with clearer information about how U.S. trade policy directly affects retail prices.

-

Consumer Awareness: Proponents of the feature argued that, in an era of growing concern over inflation and price spikes, shoppers deserve to understand the factors driving costs.

-

Competitive Differentiation: By pioneering tariff transparency, Amazon might position itself as a consumer advocate in contrast to other retailers that bundle duties and fees into a single sticker price.

-

Operational Feasibility: Internally, Amazon engineers assessed that, with existing data on tariff schedules and product origins, they could automate the calculation of estimated duties for the vast majority of imported SKUs within weeks.

Despite these potential benefits, the move posed significant risks—chief among them, antagonizing the Trump administration, which has made tariffs a cornerstone of its economic strategy.

White House Response: “Hostile and Political”

Shortly after news of Amazon’s contemplated feature broke, White House Press Secretary Karoline Leavitt issued a forceful statement:

“I just got off the phone with the president about this, about Amazon’s announcement. This is a hostile and political act by Amazon.”

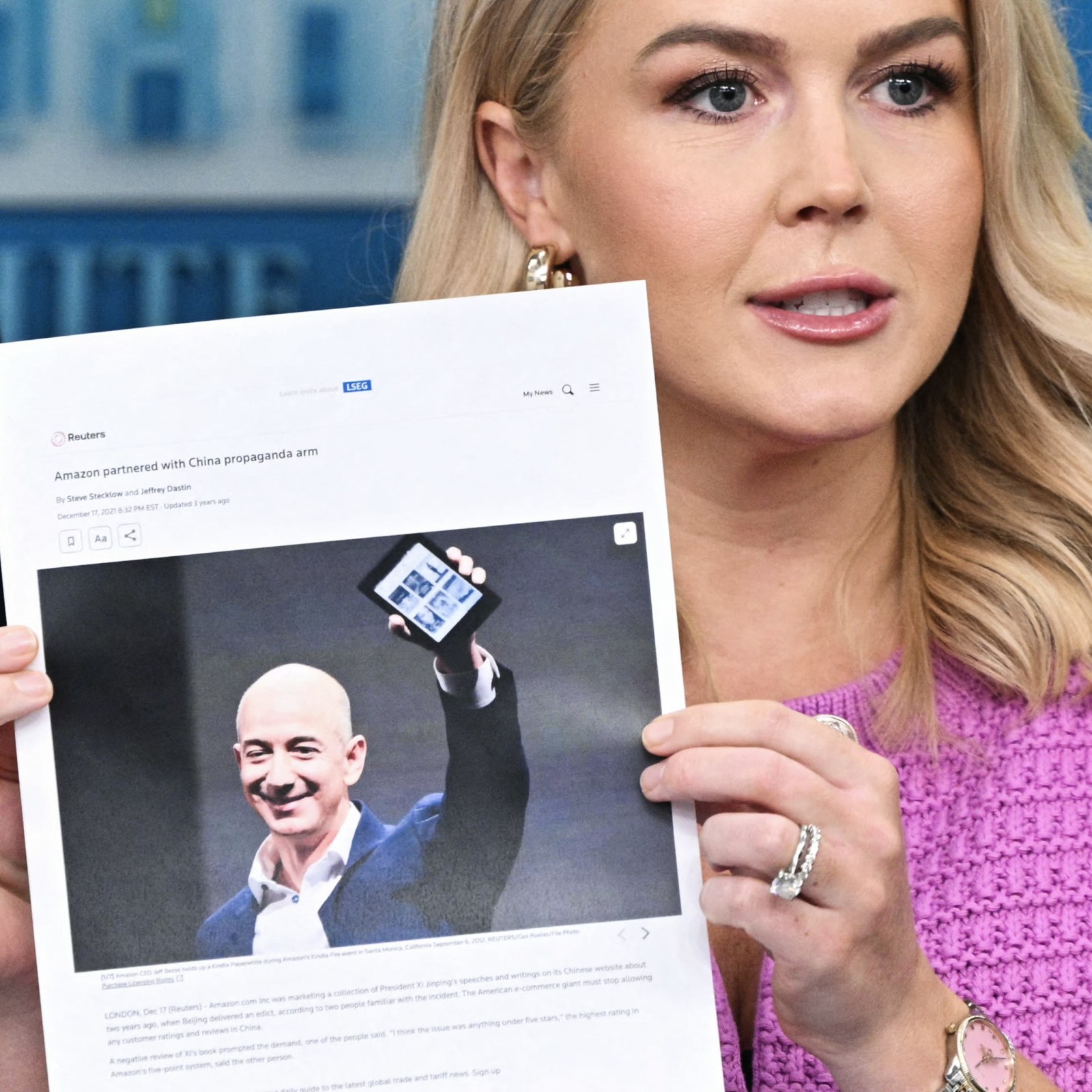

Leavitt further underscored her point by brandishing a Reuters report from 2021 that accused Amazon of partnering with what she described as a “China propaganda arm.” In doing so, she framed the tariff‐cost disclaimer not merely as a commercial decision but as an affront to the administration’s broader trade agenda.

Key Elements of the White House Pushback

-

Personal Call with the President

Leavitt’s reference to a direct conversation with President Trump signaled that the matter had escalated beyond routine press office commentary. By invoking the President’s personal engagement, the administration elevated the dispute to one of heightened political sensitivity. -

Questioning Amazon’s Motives

Labeling the plan as “hostile and political” suggested that the White House perceived Amazon’s transparency proposal as a deliberate challenge to Trump’s tariff policy rather than a neutral consumer‐centric feature. -

Historical Grievances

By citing a 2021 Reuters article alleging Amazon’s affiliation with Chinese state media, the White House aimed to remind the public of past controversies involving the retailer and its sprawling Chinese supply chain relationships.

Background on U.S. Tariff Policy

The Genesis of Tariffs Under Trump

When President Trump took office for the first time in January 2017, one of his signature economic moves was to impose steep tariffs on a variety of imported goods—most notably steel, aluminum, and a broad portfolio of Chinese imports. The stated goals included:

-

Protecting American Manufacturers: By making foreign‐produced steel and aluminum more expensive, the administration sought to revive domestic production capacity.

-

Reducing the Trade Deficit: Tariffs on Chinese goods were intended to pressure Beijing into more favorable trade terms and to reduce the U.S. trade imbalance.

-

Bargaining Leverage: Trade duties became a bargaining chip in negotiations with other major economies, from the European Union to Canada and Mexico.

Over subsequent years, however, the tariff regime proved a double‐edged sword. While some domestic producers benefited from reduced competition, many American businesses—particularly those reliant on imported intermediate goods—saw their input costs rise sharply.

Escalation and Retaliation

By mid‐2018, U.S. tariffs on Chinese goods had reached upwards of 25 percent for many product categories. China responded in kind, imposing its own duties on a host of American exports, ranging from soybeans to automobiles. The result was a familiar tit‐for-tat dynamic that rattled global supply chains and sowed uncertainty across numerous industries.

Adjustments and Delays

In the face of mounting pressure from U.S. importers and concerns about consumer price inflation, the administration periodically granted temporary exclusions for certain products, delayed tariff deadlines, and even reduced duties on some goods. Nonetheless, the overall architecture of higher border levies has largely remained intact through President Trump’s second term.

Amazon’s Historical Relationship with the Administration

Early Interactions

Jeff Bezos, Amazon’s founder and executive chair, has maintained a complex relationship with President Trump. In December 2016, Bezos donated $1 million to Trump’s presidential inaugural fund and attended the January 2017 inauguration. Yet, as Trump’s tenure progressed, the relationship soured—particularly as The Washington Post (owned by Bezos) published critical coverage of the administration.

Friction Points

-

Media Coverage: The Post’s decision not to endorse a candidate in the 2020 election sparked a backlash from some pro-Trump circles, though Bezos defended the move as a commitment to editorial integrity.

-

Editorial Direction: In February 2025, Bezos announced that the Post’s opinion section would focus on “personal liberties and free markets,” a shift that Trump later praised as evidence of a more favorable stance.

-

Public Praise and Reproach: Despite mutual criticism, Trump publicly acknowledged Bezos and Mark Zuckerberg as “great” billionaires who had earned “a higher level of respect” from him, underscoring the unpredictable nature of their dynamic.

The Mechanics of Showing Tariffs on Product Pages

Technical Requirements

Implementing a tariff breakdown for millions of items involves several core components:

-

Product Origin Tracking

Amazon’s supply chain database must accurately capture the country of manufacture or export for each SKU. -

Tariff Schedule Integration

The platform needs real-time access to U.S. Customs and Border Protection tariff codes (HTS codes) and corresponding duty rates. -

Cost Calculation Algorithm

For each product, a calculation engine would estimate the duty based on declared value, freight and insurance costs (if any), and the applicable tariff percentage. -

User Interface Design

Designers must craft clear, concise labels (e.g., “Tariff fee”) and determine optimal page placement without cluttering the shopping experience.

Potential Benefits

-

Enhanced Transparency: Shoppers gain insight into how government policy influences retail pricing.

-

Informed Decision-Making: Customers may opt for domestically produced alternatives to avoid extra costs.

-

Competitive Differentiation: Amazon could stand out as a champion of consumer rights.

Possible Drawbacks

-

Regulatory Scrutiny: Displaying tariff information might invite closer oversight from trade authorities or spark legislative backlash.

-

Public Perception Risks: Highlighting duties could fuel criticism of tariffs and of the administration, which some stakeholders might view as political alignment.

-

Operational Overhead: Maintaining accurate, up-to-date tariff data at scale imposes ongoing engineering and compliance costs.

Industry and Analyst Reactions

Retail Sector

Many retailers have quietly absorbed tariff‐related cost increases rather than itemize them for customers—preferring to adjust product pricing in aggregate. Some brick-and-mortar chains expressed interest in Amazon’s proposed transparency, suggesting that clear duty breakdowns could become an industry standard.

Trade Experts

-

Pro-Transparency Advocates: Economists who favor open markets saw the idea as a logical extension of price clarity, akin to disclosing taxes on digital services or environmental levies.

-

Free-Trade Critics: Conversely, proponents of aggressive tariff enforcement criticized any effort that might dampen public support for protectionist measures. In their view, showcasing tariff costs could undermine the political narrative that duties bolster American workers.

Investor Community

Shares of Amazon (AMZN) dipped marginally after the White House’s condemnation, reflecting concerns about political risk and potential regulatory repercussions. Some investors speculated that the administration could explore punitive actions—ranging from increased oversight to antitrust investigations—in retaliation for what it labeled a “hostile” maneuver.

The White House’s Broader Trade Messaging

By calling Amazon’s proposal “hostile and political,” the Trump administration sought to reinforce several key messages:

-

Tariffs as Pride, Not Punishment

The White House repeatedly emphasizes that tariffs are tools for protecting U.S. industries, not hidden taxes on consumers. -

Corporate Loyalty Expectations

Trump’s rhetoric often frames large corporations as allies in an “America First” agenda; actions perceived as criticism of trade policy may be met with public rebuke. -

Political Signaling

High‐profile clashes—such as this one with Amazon—serve to rally the administration’s base by portraying external entities as adversaries of national economic interests.

Amazon’s Official Statement

In response to intense media scrutiny, Amazon released a concise statement to The Washington Post:

“Adding the cost of tariffs was never a consideration for the main Amazon site. This was never approved and is not going to happen.”

This clarification indicated that the feature had been discussed internally but lacked formal endorsement from senior leadership. By categorically denying imminent implementation, Amazon aimed to defuse tensions and reassure both customers and investors.

What’s Next?

As of late April 2025, the tariff‐cost disclosure feature remains shelved, with no further movement toward public rollout. However, the episode raises lingering questions:

-

Will Amazon revisit the idea once public attention subsides?

-

Could other retailers pilot similar transparency features?

-

Might Congress or the U.S. Trade Representative take a closer look at how tariffs are communicated to consumers?

For now, Amazon appears to have stepped back from a direct challenge to White House trade policy, but the broader debate over tariff transparency is far from over.

Conclusion

The brief but intense skirmish between Amazon and the White House over tariff‐cost disclosures highlights the delicate balance major corporations must strike when navigating politically charged policy arenas. While Amazon’s initial proposal reflected a genuine interest in consumer transparency, the administration’s swift denunciation underscored how deeply tariffs remain entwined with national pride and political identity. Though Amazon ultimately abandoned the initiative, the episode may well resurface as both businesses and policymakers continue to weigh the benefits—and pitfalls—of laying bare the true cost of trade protectionism.

Adrian Hawthorne is a celebrated author and dedicated archivist who finds inspiration in the hidden stories of the past. Educated at Oxford, he now works at the National Archives, where preserving history fuels his evocative writing. Balancing archival precision with creative storytelling, Adrian founded the Hawthorne Institute of Literary Arts to mentor emerging writers and honor the timeless art of narrative.